Cracking the Retention Code: Why Do Call Centers Have High Turnover Rates?

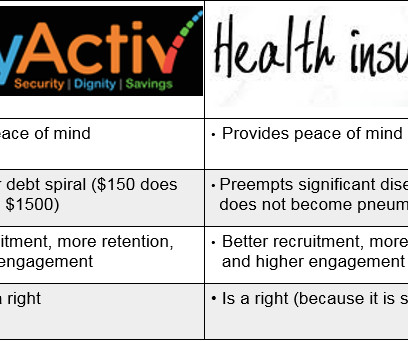

Payactiv

OCTOBER 31, 2024

However, the employee experience is equally important, especially given that the call center industry is renowned for its high turnover rate. In this article, we’ll explore the most common causes of high call center turnover and some strategies for greater employee retention. Why Do Call Centers Have High Turnover Rates?

Let's personalize your content