Resolving Important Issues in HR Audits

PCS

JULY 9, 2023

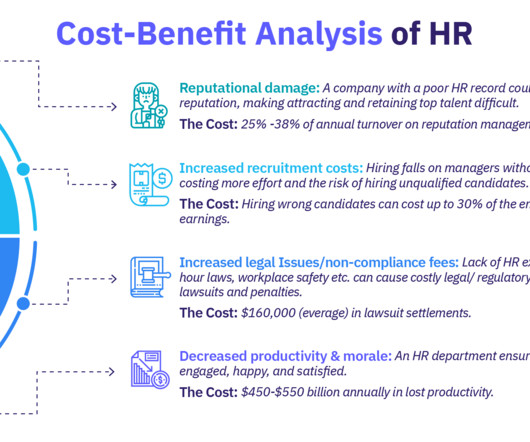

These include employee files, training and benefits reports, and performance reviews. Erratic Hiring Practices These can result in discrimination claims, which in turn, leads to a diverse workforce. Some of these issues are failure to provide employee benefits and pay overtime work.

Let's personalize your content