Does Your Business Need An Employer Of Record?

Hppy

MARCH 28, 2023

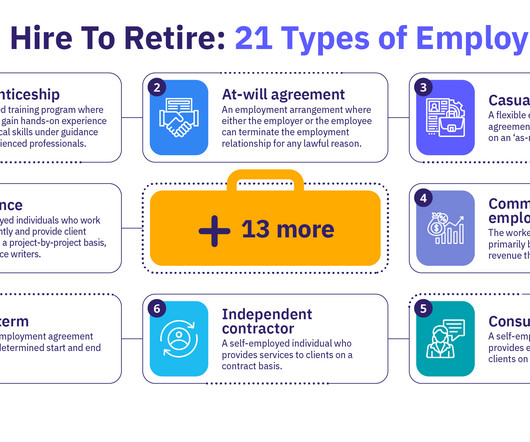

Partnering with an employer of record can help you take advantage of an international talent pool. What Is An Employer Of Record? An employer of record (EoR) is an individual or third-party company that works by assuming the legal responsibility for finding and hiring employees on behalf of foreign business owners.

Let's personalize your content