Hotel Workers Strike Disrupts Major Cities Nationwide in 2024

Heyyy HR!

SEPTEMBER 4, 2024

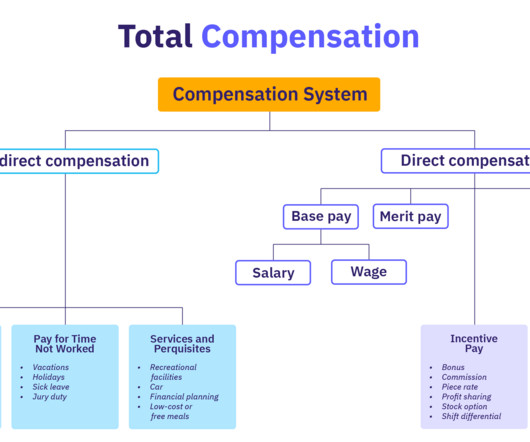

Service Disruptions The absence of thousands of workers is causing service disruptions at numerous hotels. Benefits : Enhanced healthcare and retirement benefits are a priority. You can expect other labor groups to look at these strikes as a model for action.

Let's personalize your content