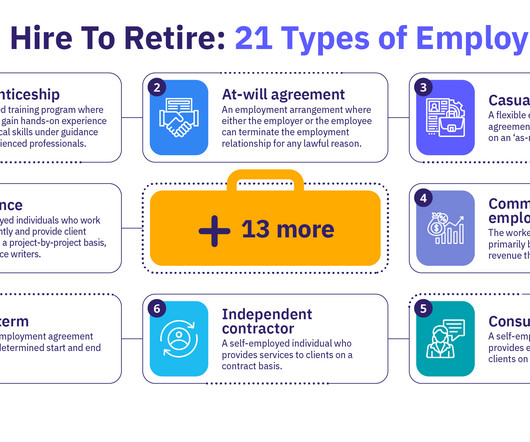

21 Types of Employment: Your Hire-To-Retire Guide

AIHR

NOVEMBER 12, 2024

When to offer it: When your company requires highly skilled workers in specialized trades, you want to build a robust talent pipeline or prioritize long-term workforce development and retention. At-will agreement This employment type is the most common in the U.S., Some employers may also offer a base salary in addition to commissions.

Let's personalize your content