Employee Classification: A Practical Guide

AIHR

MARCH 9, 2022

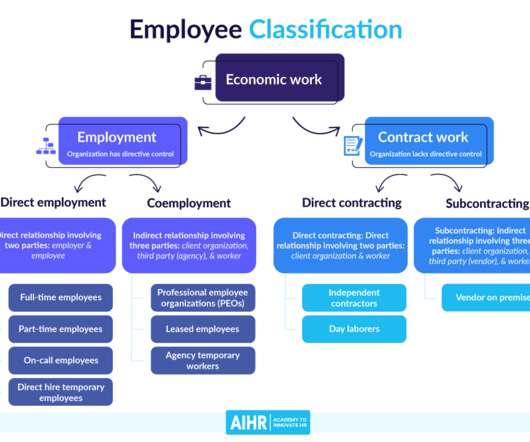

The labor market is currently going through a period of change that impacts all its members, including employees, employers, and independent contractors. As more people find new ways to earn a living, businesses and organizations have to adapt to a more complex workforce with new roles and demands. What are the types of employees?

Let's personalize your content