HRIS vs. ATS: Which HR Tool Best Fits Your Business Hiring Needs?

HR Lineup

SEPTEMBER 28, 2024

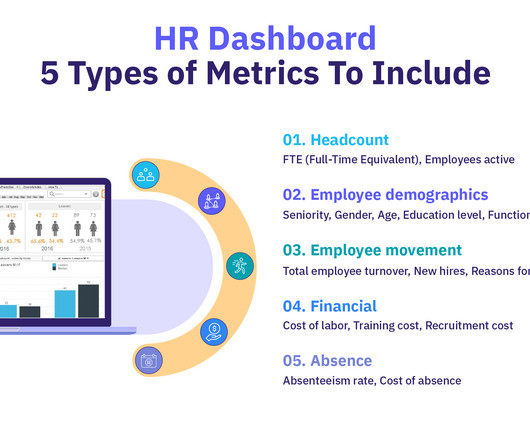

It is designed to manage various HR functions, ranging from employee data management and payroll to performance reviews, time tracking, and benefits administration. Essentially, an HRIS acts as a centralized database for all employee-related information.

Let's personalize your content