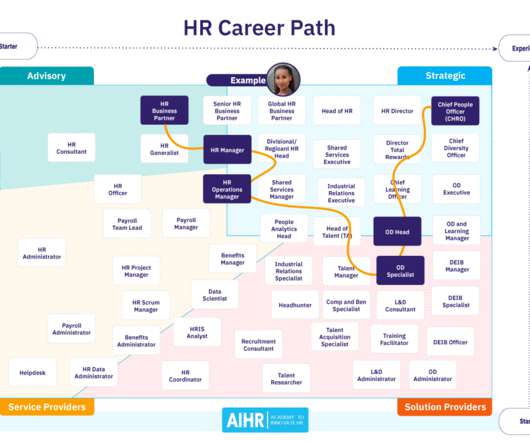

HR, Training and the ‘Gig’ Economy

HRExecutive

JULY 13, 2015

New survey data finds few organizations are investing in their employees’ training and development these days, and I’m beginning to think the “gig economy” may have something to do with it. For those companies that are providing training, only 35 percent are offering career development opportunities online.

Let's personalize your content