HRIS Requirements Checklist: A Guide for Getting Started

Analytics in HR

JULY 27, 2021

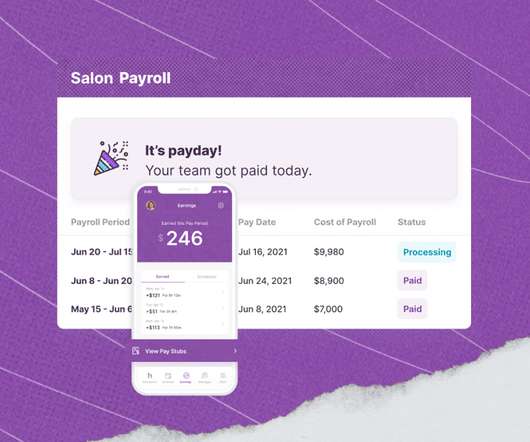

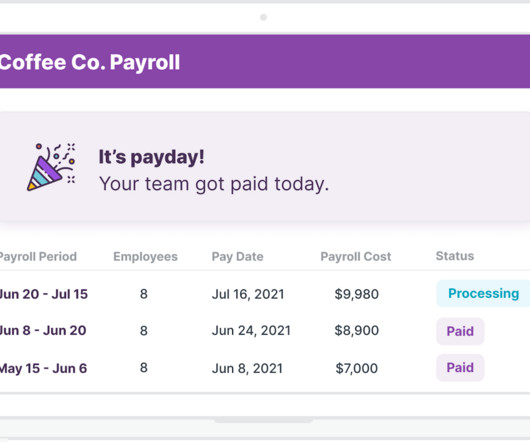

Insurances PTO Travel compensation Retirement plans Employee wellness programs. First of all, it must support compliance with local and national employment laws and regulations. For example, if you change an employee’s pay rate in the payroll system, it will be automatically updated in every other applicable record.

Let's personalize your content