Leave Management: Your 101 Guide for 2024

Analytics in HR

FEBRUARY 27, 2024

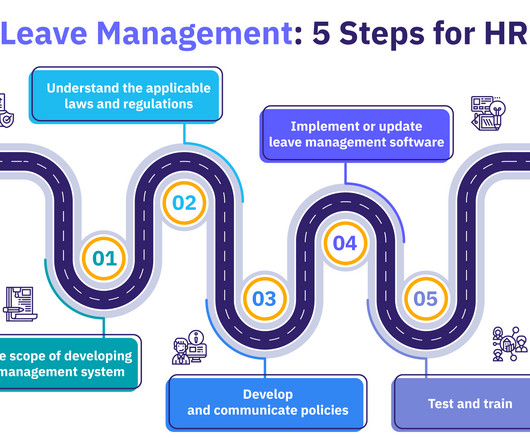

Benefits and challenges of employee leave management The 5 key processes of leave management Leave management software providers What is leave management? According to a Facts and Factors market research report , the global absence leave management software market will grow by 9.3% from 2020 to 2026, reaching a staggering USD 0.95

Let's personalize your content