Salary or hourly? Here’s the best way to pay employees

Homebase

JUNE 23, 2023

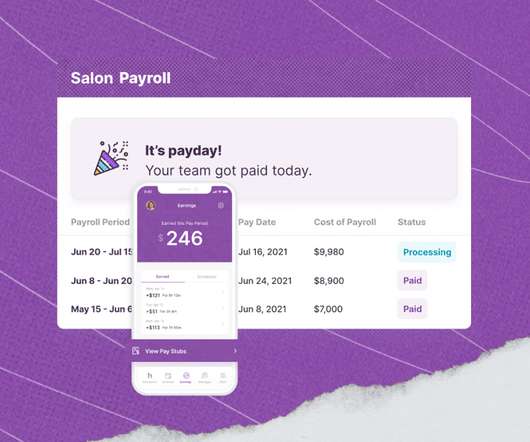

Hiring your first employee or expanding your team is a big deal in the world of small business. Read on to learn more about the different types of employees. We’ll break down the best way to pay employees, how to use time tracking to make things easier, and why you need a solid payroll system to make it all come together.

Let's personalize your content