Ideal Payroll Services for Small Enterprises

PCS

MARCH 8, 2023

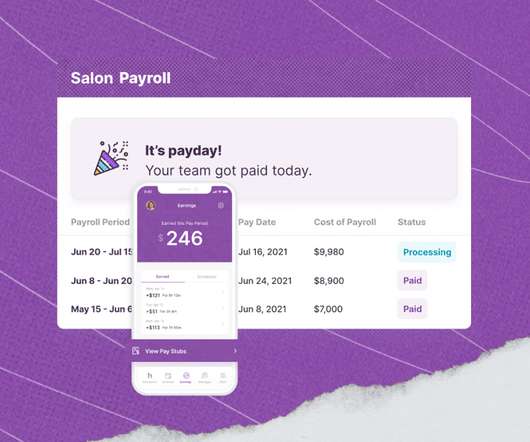

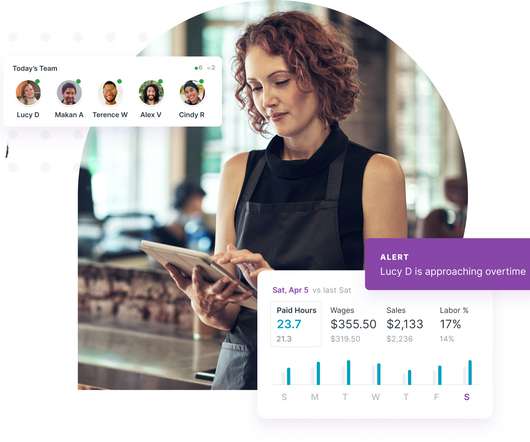

Many owners of startup companies outsource payroll services to third-party entities. In choosing payroll services for small business , the key is to consider the features of the software that providers use. Moreover, look for payroll services for small business with a credible background and positive reviews.

Let's personalize your content