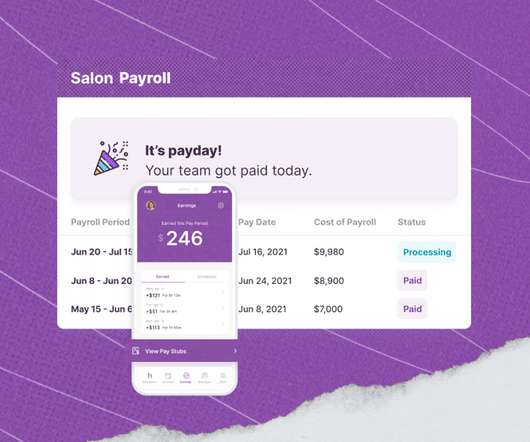

Top 6 Paylocity alternatives and competitors (in-depth comparison)

Homebase

JUNE 21, 2023

Cloud-based Paylocity is one of the leading human resources and payroll platforms in the United States. And because Paylocity has a steeper learning curve, it can lead users to find implementation “ difficult and stressful ” or even “ chaotic.” One easy app to manage your hourly team. Why might you choose a Paylocity alternative?

Let's personalize your content