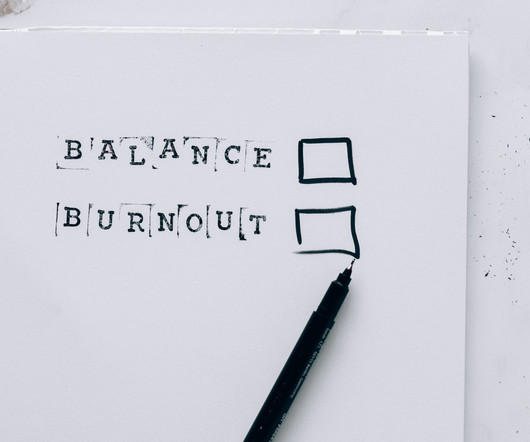

Employee Burnout: 4 Ways Technology Can Help

HR Bartender

AUGUST 30, 2016

Department of Labor changes to overtime pay, Kronos has published a research brief on The Changing Face of Wage and Hour Law. (Editor’s Note: Today’s post is brought to you by our friends at Kronos , the global leader in delivering workforce solutions in the cloud. To help employers navigate the upcoming U.S. Enjoy the post!).

Let's personalize your content