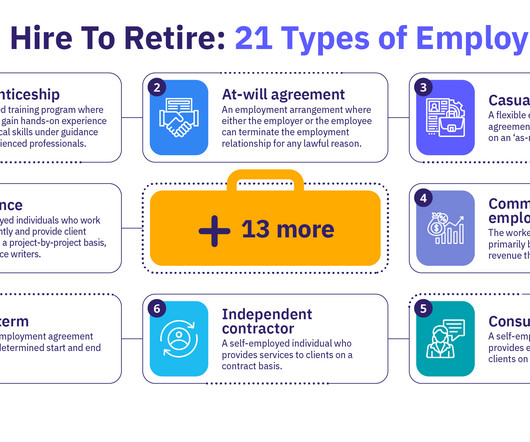

21 Types of Employment: Your Hire-To-Retire Guide

Analytics in HR

NOVEMBER 12, 2024

As the job market evolves, companies are experimenting with various employment types to build more flexible staffing models. However, top candidates are usually off the market in just 10 days. This article looks at 21 different types of employment and how they can benefit your organization.

Let's personalize your content