Top 6 Paylocity alternatives and competitors (in-depth comparison)

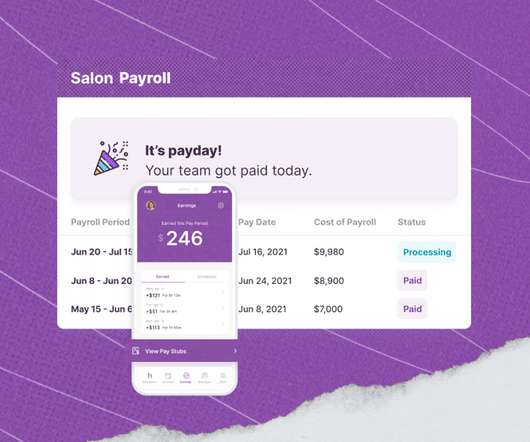

Homebase

JUNE 21, 2023

To narrow down your search, we’ve researched all the best Paylocity alternatives using independent software review platforms like G2 and Capterra. Get your team in sync with our easy-to-use, all-in-one employee app. Cloud-based Paylocity is one of the leading human resources and payroll platforms in the United States.

Let's personalize your content