Nonprofit HR | Complete Overview for Small Organizations

Astron Solutions

OCTOBER 15, 2019

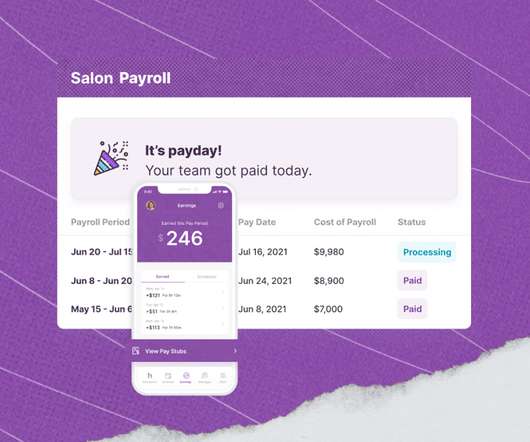

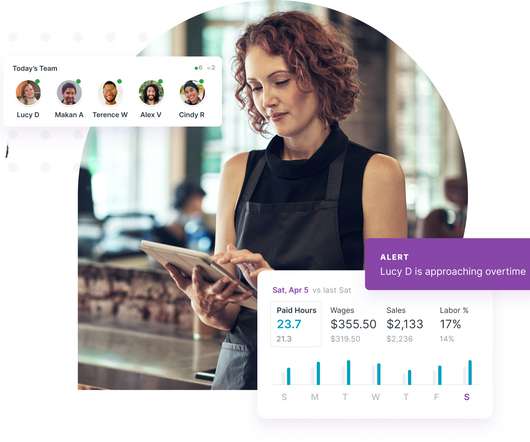

This is because nonprofit HR encompasses areas that are both important for developing strong teams and required for compliance with federal, state, and local law. However, while nonprofit HR and for-profit HR have shared compliance needs, they also differ in a few key ways: Nonprofit HR vs. For-Profit HR. Payroll & Taxes.

Let's personalize your content