Workforce Changes Now Will Affect ACA Reporting Later

ACA Times

MAY 13, 2020

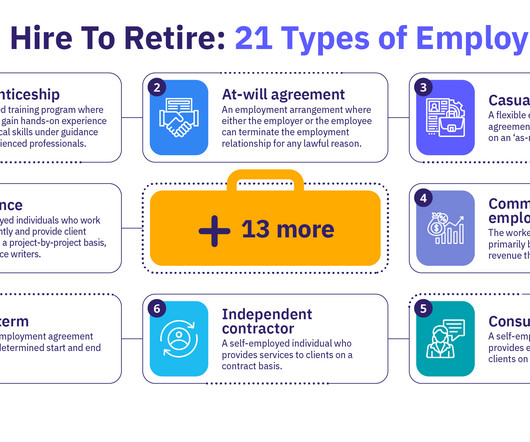

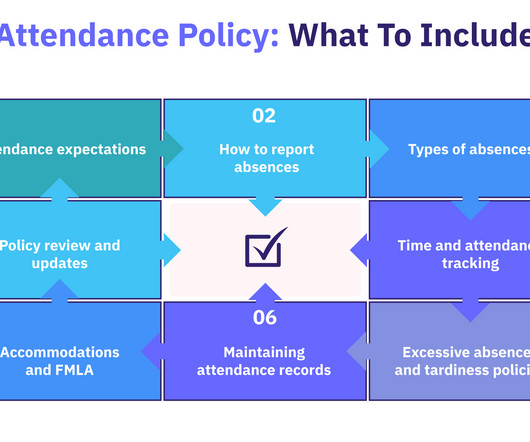

Something just as important that we have yet to touch on however, is how these layoffs, furloughs, and employment classification changes manifest themselves in the annual 1094-C and 1095-C filings with the IRS. If you’re unsure of the coding to use, click here to learn about the different scenarios.

Let's personalize your content