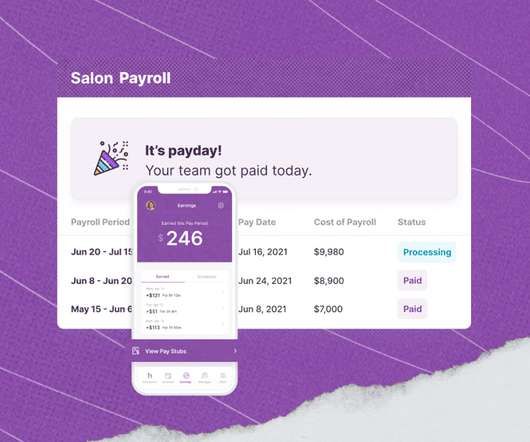

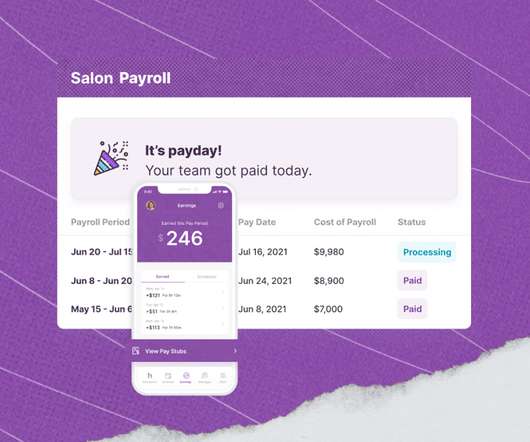

The Best Payroll Software For Small Businesses

TrustRadius HR

JULY 6, 2022

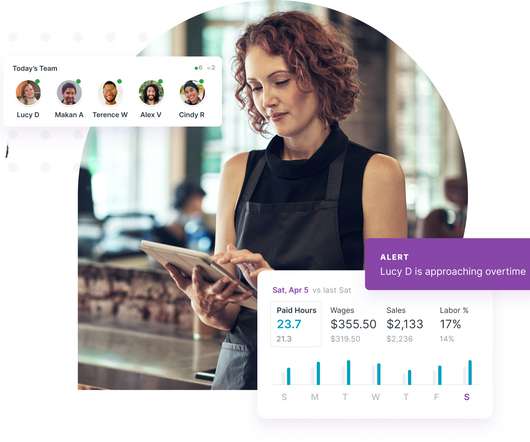

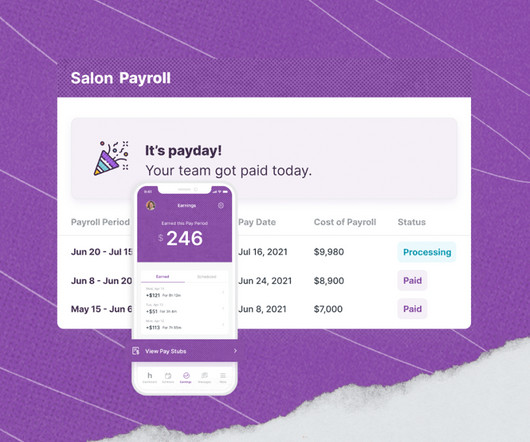

These include the type of workers they cover (most workers are either W-2 or 1099s), frequency of payroll, off-cycle payroll, and hourly and salaried wage support. The average small business owner spends nearly five hours per pay-period processing payroll (Try saying that five times fast). 45% said that outsourcing payroll was too costly.

Let's personalize your content