8 Best Payroll Software 2024

HR Lineup

FEBRUARY 5, 2024

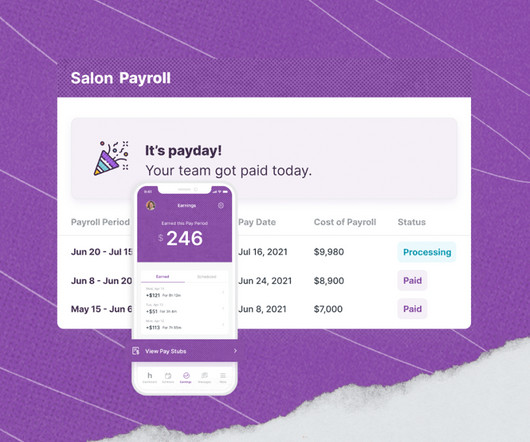

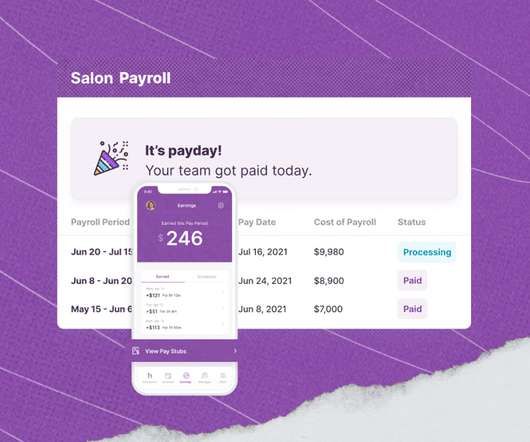

Any business requires the best payroll software 2024 to manage its employees’ payroll. The software should be very effective to manage taxes and employee benefits. It should also ensure that employees receive accurate information concerning their wages/salaries or any other deductions.

Let's personalize your content