Small Businesses Gain from Online Payroll Services

PCS

MAY 1, 2023

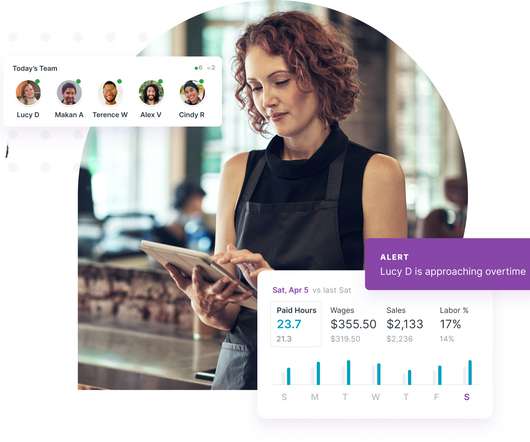

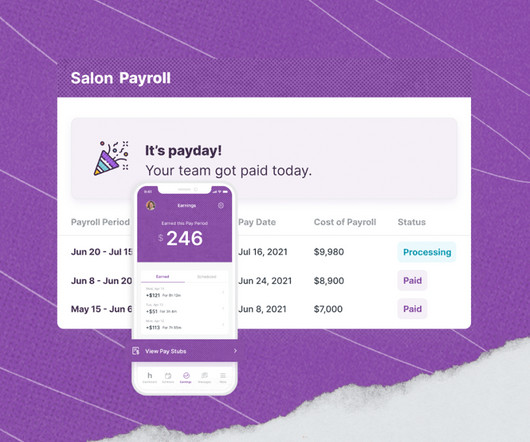

Payroll requires time, financial resources, accuracy, and training. This is why even these micro enterprises choose to work with online payroll services for small business. The web-based payroll service provider performs these tasks: Monitor tax information of employees. Track attendance and paid time-off.

Let's personalize your content