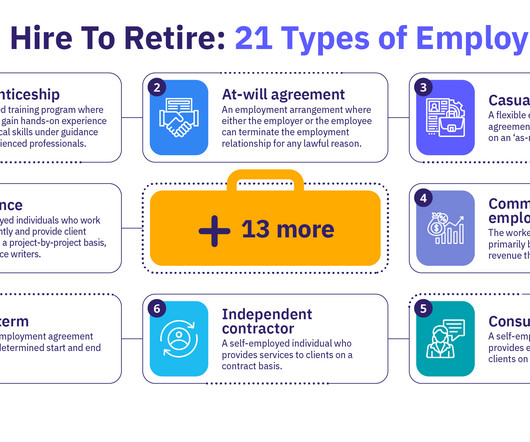

21 Types of Employment: Your Hire-To-Retire Guide

Analytics in HR

NOVEMBER 12, 2024

In AIHR’s Sourcing and Recruitment Certificate Program , you’ll learn to source and engage passive candidates, avoid mishires with effective screening, and build an influential employer brand. Leased employment Leased employment involves companies contracting with third-party staffing agencies to hire workers.

Let's personalize your content