Report: HR Trends 2024 – Navigating the Future of Work

Extensis

DECEMBER 20, 2023

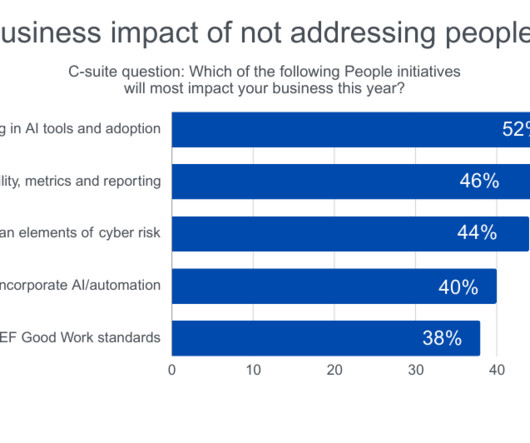

The speed at which the business landscape is evolving means employers must quickly adapt to remain competitive; gone are the days of researching emerging trends and bookmarking them for later. You may also download the complete report , which provides more in-depth information and actionable guidance.

Let's personalize your content