Payroll Congress

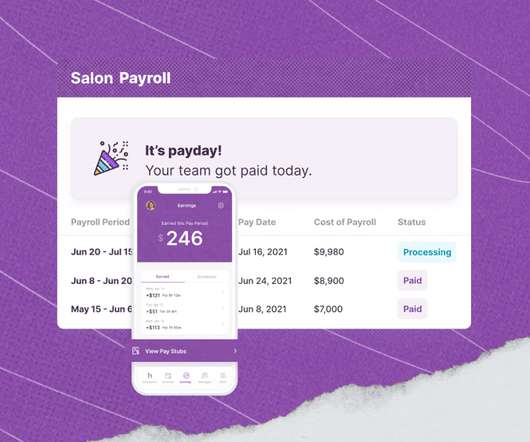

DailyPay

APRIL 12, 2023

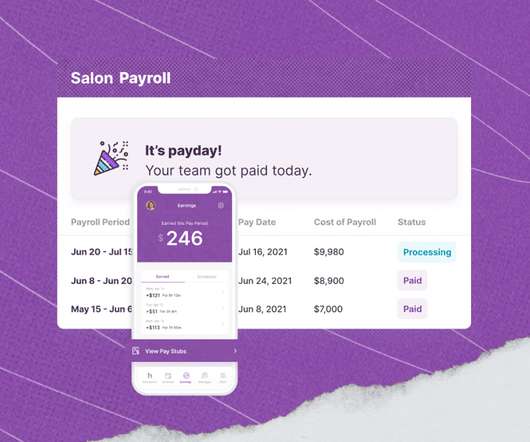

Make Payroll a Strategic Advantage With On-Demand Pay Join us at The 41st Payroll Congress to learn why on-demand pay is this year’s hottest benefit that employees are asking for. Get all your payroll-related questions answered 1-on-1 and learn how DailyPay can improve employee productivity, retention and more.

Let's personalize your content