10 Top Tips for getting your HR in order for 2023

HR Partner

DECEMBER 4, 2022

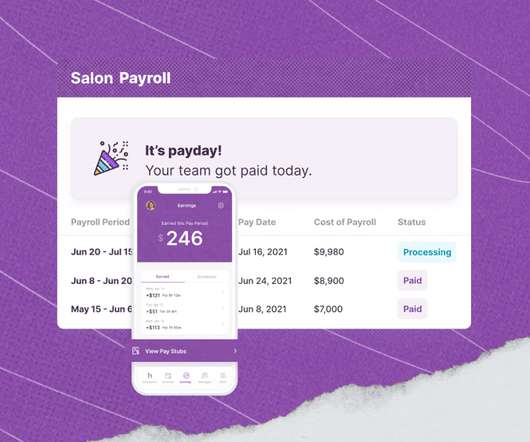

You may have your HR system setup so that line managers can approve leave requests, but at this time of year, it might be a good idea to do a sense-check of this. Ensure proper end-of-year Vacation Time / Time Off carryover is set up – both in your payroll system and HR software. Prepare Payroll Ahead of Time.

Let's personalize your content