Succession Planning: Essential Guide for HR

Analytics in HR

FEBRUARY 17, 2023

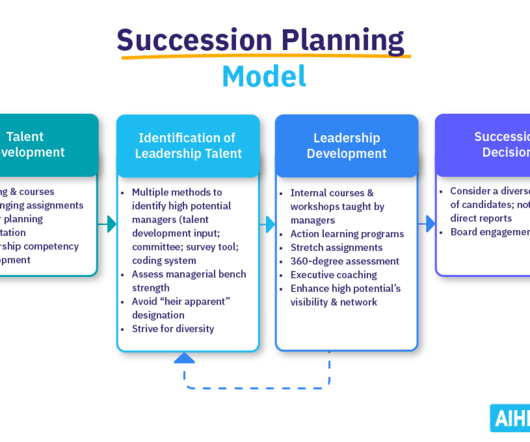

Succession planning is essential to ensure critical roles in a company are not left vacant for extended periods or filled by people who don’t have the skills or knowledge to perform in the role. That means that over half of the organizations the surveyed HR professionals work at didn’t have a plan.

Let's personalize your content