What to look for when choosing a payroll provider

Homebase

OCTOBER 19, 2021

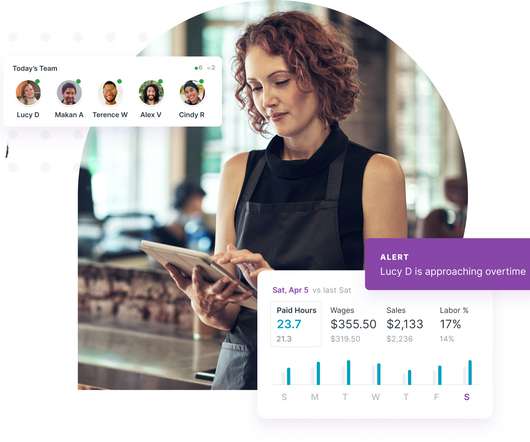

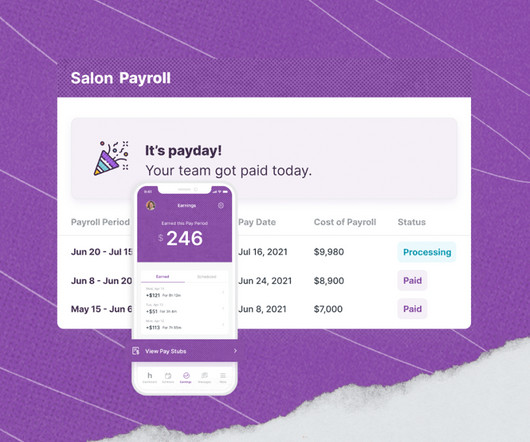

Payroll is critical to your business and involves several moving parts, including computing hours, withholding and paying taxes, submitting payroll tax forms, and collecting funds for retirement and insurance. Many small businesses rely on antiquated payroll solutions to organize and track data. Make payroll painless.

Let's personalize your content