Guide to Hiring Employees in Armenia

Recruiters Lineup

JANUARY 22, 2024

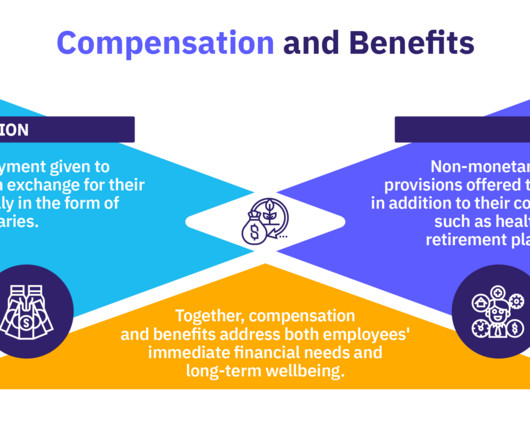

Additionally, the employment contract should specify the details of the compensation package, including any bonuses, benefits, or allowances offered to the employee. Payroll and Taxes in Armenia It’s crucial for employers and individuals to stay informed about any changes in tax and payroll regulations.

Let's personalize your content