Guideline Now Integrated With RUN Powered by ADP®

Guideline

MAY 9, 2019

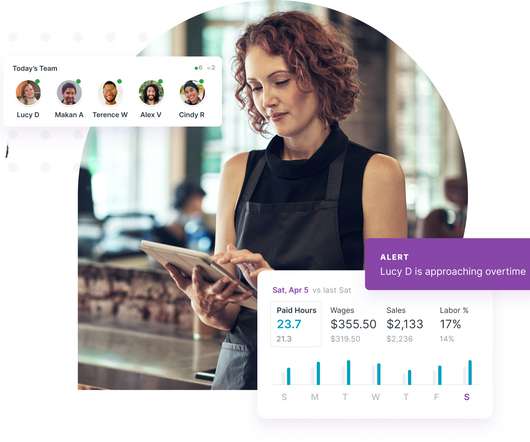

In March, we announced our integration with ADP Workforce Now ®. Today, we’re expanding our partnership to include an integration with RUN Powered by ADP® , an offering designed to make payroll quick and automated, used by more than 500,000 small businesses. The integration works just like it does with ADP Workforce Now ®.

Let's personalize your content