What’s New in the EEOC’s 2022-2026 Strategic Plan?

HR Digest

AUGUST 25, 2023

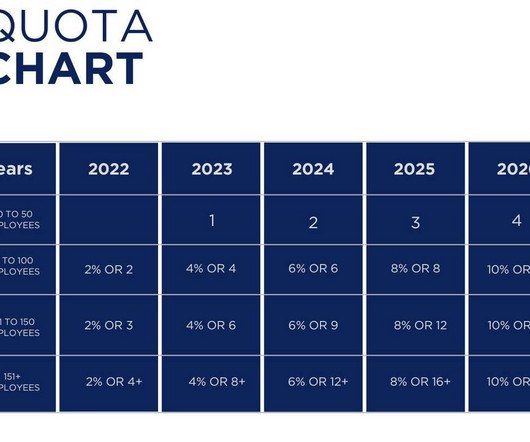

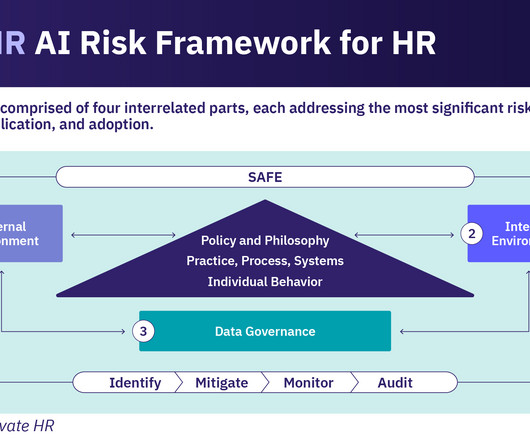

Stay tuned to discover how the EEOC’s 2022-2026 strategic plan sets the stage for fostering inclusive and diverse workplaces across the nation. Analysis of the EEOC’s 2022-2026 Strategic Goals The EEOC’s 2022-2026 strategic goals provide further insights into the agency’s priorities for the coming years.

Let's personalize your content